pay utah withholding tax online

This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file. Professional Licensing and.

Income Tax Of India Income Tax Online Education One Liner

Rememberyou can file early then pay any amount you owe by this years due date.

. Can I pay my Utah state taxes online instead of mailing it. CFS does not support e-filing of payments. You may prepay through withholding W-2 TC-675R 1099-R etc payments applied from previous year refunds credits and credit carryovers or payments made by the tax due date using form TC-546 Individual Income Tax Prepayment Coupon or at taputahgov.

For security reasons TAP and other e-services are not available in most countries outside the United States. If you cannot locate your PIN please call the Department at 866-435-7414. Use this coupon to make payments by check with Form TC-941.

You may also pay with an electronic funds transfer by ACH credit. This registration is to obtain tax accounts for the Utah State Tax Commission only. Follow the instructions at taputahgov.

You have been successfully. Register with the Utah Department of Workforce Services 866-435-7414. 8AM-5PM Monday-Friday ORS Contact Info.

Filing Paying Your Taxes. You may file your withholding returns online at taputahgov or by submitting a completed paper form. It does not contain all tax laws or rules.

Calculate the FUTA Unemployment Tax which is 6 of the first 7000 of each employees taxable income. Utah encourages filers to make payments electronically online. HttpstaptaxutahgovTaxExpress_ To register for a withholding account go to Apply online area Click Apply for Tax accounts TC-69 Instructions.

Do not staple your check to your return. 495 0 Vt. Employers also have to pay a matching 62 tax up to the wage limit.

Visit Utahgov opens in new window Services opens in new window Agencies opens in new window Search Utahgov opens in new window Skip to Main Content. It does not mean a parent had to be forced to support their child. Level 15 June 1 2019 107 PM.

It does not contain all tax laws or rules. Make a Payment Online. If you pay Utah wages to Utah employees you must have a Withholding Tax license.

Do you need to apply for a tax account. 600 0 700 10000 850 25000 Va. Added county withholding tax and non resident tax.

Please contact us at 801-297-2200 or taxmasterutahgov for more information. Pay by Mail You may also mail your check or money order payable to the Utah State Tax Commission with your return. Employers may file the above reports TC-941E and TC-941D and remit withholding taxes TC-941PC by using Utah State Tax Commissions Taxpayer Access Point system.

You can also pay online and avoid the hassles of mailing in a check. Workers Compensation Coverage administered by the Utah Labor Commission. You may also need.

Believes led to state being mainly a commuter state for work 1967 Present. Gross Receipts Tax Utah. For security reasons TAP and other e-services are not available in most countries outside the United States.

Change or Display to update your current amount select Change and and you are able to change your filing status as well as the number. Most states require taxpayers to make quarterly estimated tax payments not expected to be satisfied by withholding tax. Please note that for security reasons Taxpayer Access Point is not available in most countries outside the United States.

Log into the Employee Self Serve ESS System and look for the Personal Information section select the W-4 Tax Withholding option. Please contact us at 801-297-2200 or taxmasterutahgov for more information. Online at taputahgov through a bank debit e-check or a credit card or.

On the bottom left hand side of the page find the Payments box and select Make a. Employment Taxes and Fees. Unemployment Insurance administered by the Utah Department of Workforce Services.

Remove any check stub before sending. Form TC-941PC Payment Coupon for Utah Withholding Tax is due monthly quarterly or annually based on the assigned payment schedule. Note that if you pay state unemployment taxes in full and on time you are eligible for a tax credit of up to 54 which brings your effective FUTA tax rate to 06.

Withholding Tax Payment Instructions You may pay your Utah withholding tax. Write your daytime phone number and 2021 TC-40 on your check. You must include your fein and withholding account id number on each return.

Ad Pay Your Utah Dept of Revenue Bill Online with doxo. Utah Taxpayer Access Point TAP TAP. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

In that way income withholding for child support is like money taken out for taxes. Interest is assessed on unpaid tax from the original filing due date until the tax is paid in full. Salt Lake City Utah 84116.

Return to Tax Listing. Utah has a very simple income tax system with just a single flat rate. Unemployment tax payment can be completed on Unemployment Insurance and New Hire Reporting web site httpsjobsutahgovuiemployeremployerhomeaspx without signing in.

Your PIN information is only necessary for the event that we need to access your account for a correction or a one-off activity. 0 1 523 Reply. Online payments may include a service fee.

You are about to complete the Utah State Business and Tax Registration TC-69. You will then see a table that displays your current selection below the table you should see two options. You can pay online with an eCheck or credit card through Taxpayer Access Point TAP.

Form 33H Employer Contribution Report is due. You can pay taxes online using the eftps payment system. Income withholding does not mean that a parent has failed to pay in the past.

Utah State Tax Benefits Information

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Ricevimenti Valutazione

2020 Contribution Limits Increase For Utah Income Tax Credit Or Deduction

Utah State Tax Benefits Information

New Jersey Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Utah State Tax Commission Official Website

Which Is Best Health Insurance Policy For Income Tax Saving In India Cheap Car Insurance Quotes Compare Quotes Insurance Quotes

Utah Tax Attorneys 801 676 5506 Free Consultation Tax Lawyer Tax Attorney Family Law Attorney

Utah Sales Tax Small Business Guide Truic

Utah State Tax Benefits Information

Amazon Tax Law Infographic By Fifth Gear Amazon Tax Infographic Tax

Emily S Virtual Rocket Donald Trump Supreme Court Won T Stop Grand Jury Irs Tax Forms Tax Forms Income Tax Return

What Is A Mortgage Loan Mortgage Loans Mortgage Home Mortgage

Free Utah Payroll Calculator 2022 Ut Tax Rates Onpay

Irs Forms 1040 Google Search Irs Tax Forms Tax Forms Income Tax Return

Utah State Tax Commission Official Website

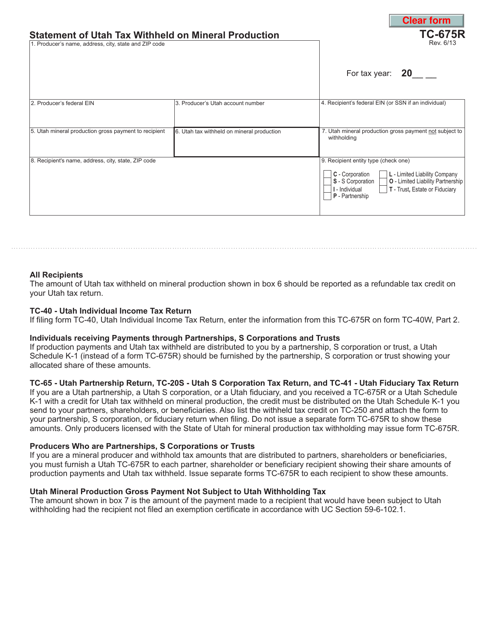

Form Tc 675r Download Fillable Pdf Or Fill Online Statement Of Utah Tax Withheld On Mineral Production Utah Templateroller